Many new features accompany the start of the new year in this update to the Apollo Infinity features blog. These new developments are all available to our partners right now.

These include advances in loan handling, automations and member experience. We also look ahead to what we intend to achieve in 2020.

Each feature has a code that may optionally be quoted to us for ease of reference in discussion.

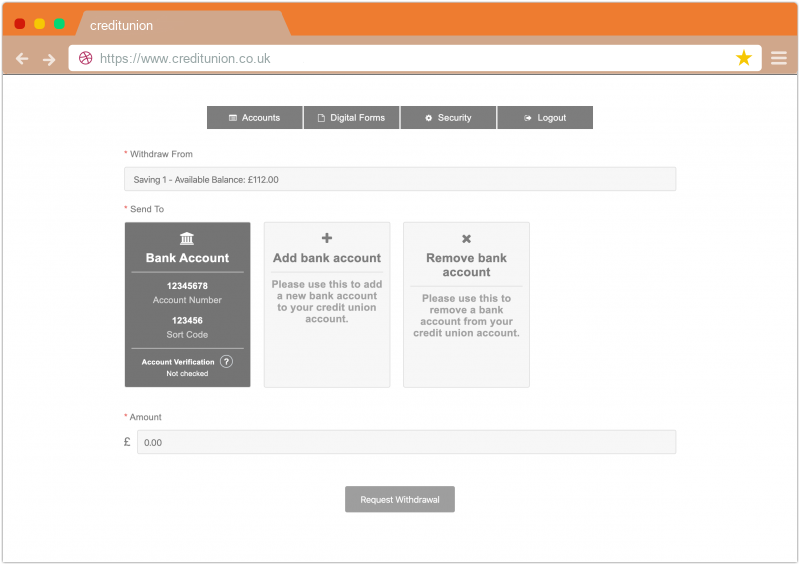

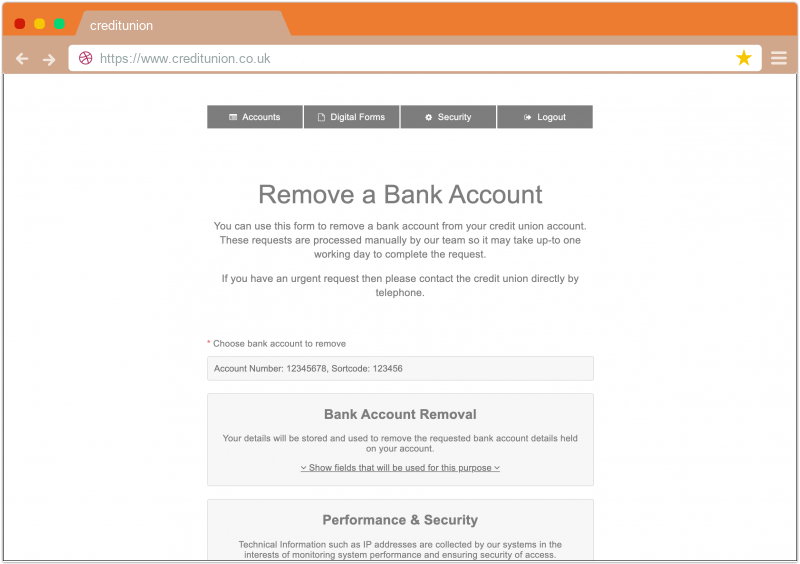

Remove Bank Accounts - User experience

APW-380 The Viva IT team acted on feedback from one of our Apollo partners that back account removals could be made more intuitive for their members, we introduced a button on the main accounts page of our web portal to "Remove a Bank account".

This takes the member to a very simple form where they can select one of the existing bank accounts and automatically request a removal.

The good news for other partners is, seeing the benefit of this feature could be applied more widely, we were able to implement the feature across all other partners.

This feature demonstrates that advances with one partner on our service can benefit the Apollo Infinity community as a whole.

Loan Applications: Customise process by value

INT-358 Loan applications entering the Launchpad module of Apollo can now be automatically filtered by their principal monetary values. This enables smart filtering of high or low value loans for which a 'one size fits all' approach is sometimes wasteful or inneffecient.

Your lower value loans might go through a shorter approval path, perhaps not running the same credit checks or requiring the same validation as higher value loans.

If you have different processes for different value loans, talk to us about setting up these smart and automated routes for your financial institution.

Loan Applications: Intelligently select loan product

INT-359 Often working in tandem with INT-358 (customising process with value), this feature allows different loan products with different APR's to be applied based on information provided on one loan form.

For example, if on your applicants loan form a certain value threshold has not been met, the application can be imported to your back office under a different product code, (as well as potentially being routed through a different process).

Loan principal is not the only decider however; the result of a check for CCJ's could alter the product as another example.

Loan Applications: Eligibility determines visibility and availability

APP-425 Apollo Infinity can effortlessly cope with varied loan products, applications and member profiles once we are given the relevant elegibility and lending rules to allow us to tailor your service.

Deceptively simple, but extremely useful to nearly all credit unions and community banks, this feature allows sets of members to view and apply for different promotions and products and also saves organisations the headaches associated with refusing applications based on eligibility.

This opens up further opportunities such as targeted promotions to selected cohorts. As long as we can identify a cohort from data stored on your back office, we can tailor and personalise their experience of your services accordingly.

If exceptions are a regular occurance then eligibility can be overridden on a case by case basis by your staff (using our interlinked Airlock module).

Handling Custom Information and Answers

INT-390 Apollo partners can reduce the amount of manual processing of member submitted information. Specifically, our forms can be made compatible with customised back office data fields which you have used to store specific unique information via our digital forms.

Specifically, some of our clients have historically stored marketing preferences and certain dates in custom fields which have needed to be manually maintained, but which may now be automatically imported from member submitted information.

Time based Processes

INT-737 Many credit unions, community banks or similar financial institutions expect members to be responded to with a confirmatory message acknowledging various requests, for example 'Thank you for your request, it will be processed shortly'.

The new time based intelligence we have built into Apollo allows for different automated processing workflows based on the time. For the simple example response above, if the member emailed out of hours they could recieve different wording to if it was during the working day, perhaps stating that it will be looked at when they staff are next in.

This feature is not restricted to messaging. One credit union partner uses this feature to batch up transaction requests which occur after a certain time, so that the automated services we offer are in synchronisation with their service level agreements to their membership.

Messages or tasks could also be routed to different teams based on time/date.

Talk to us about this feature if you need your processes to adapt based on time to fit your needs - rather than the other way around.

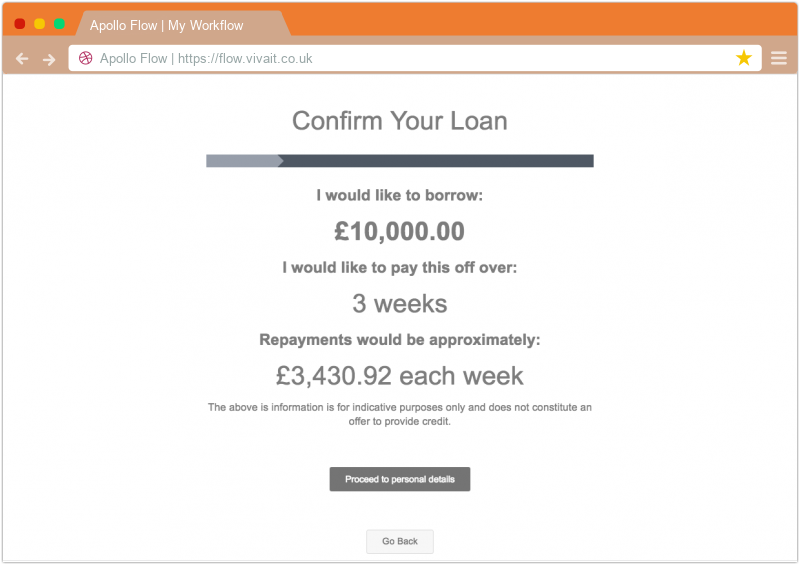

Indicative Repayment Summary

APF-479 We have introduced an optional repayment confirmation page into the loan forms which we serve to Apollo members. This is dynamically calculated based on the principal and interest rate.

Without this, errors on applications might go unnoticed until either a staff member raises a time consuming query - or rejects the application, or the member/customer potentially recieves a different loan amount or term than they thought.

By showing the member what they have applied for in a different and summarised format, there is a greater chance of them catching before the application is even submitted.

This feature can be added to any loan application that has a predictable APR.

Coming in 2020...

Among the new features we have planned for this year, a key headline will be Open Banking.

We will integrate Open Banking API technology into the Apollo platform to help more automated processing of affordability for loan applications, and reducing the hassle of chasing for proofs.

But this is just the start.

We see much more potential in what we can help our partners in the ethical lending space achieve by integrating closely and intelligently with Apollo users spending and savings habits.

We are developing 'nudge' features that will embed into the mobile app and web portals we offer end-users and which will pick up on opportunities to guide people into healthier financial decisions whether in offering lending alternatives to spread the cost of a big purchase, or helping to reduce certain discretionary expenses.

In Summary

If you are already participating in the Apollo Infinity programme then you are already eligible to begin using the optional features discussed above and your next step would be to talk to your account manager or main contact at Viva IT.

We hope this series of posts showcasing new features available to our Apollo Infinity participating partners encourage new organisations to reach out to us for a no-obligation consultation about your specific requirements.

Review previous Apollo blog posts here.

Find out about joining our proven Apollo Infinity programme here.

or simply: